-

Happy Feet left Positive feedback for Mithras

-

JMAuction - 22/10/2025 - Results!

sold mine to irish greg Monique - 1342£ daft price

-

Manship half price sale

thought i would have a look one example Gene Chandler – Does She Have A Friend? £14 from me £2 over priced right through wast of time

-

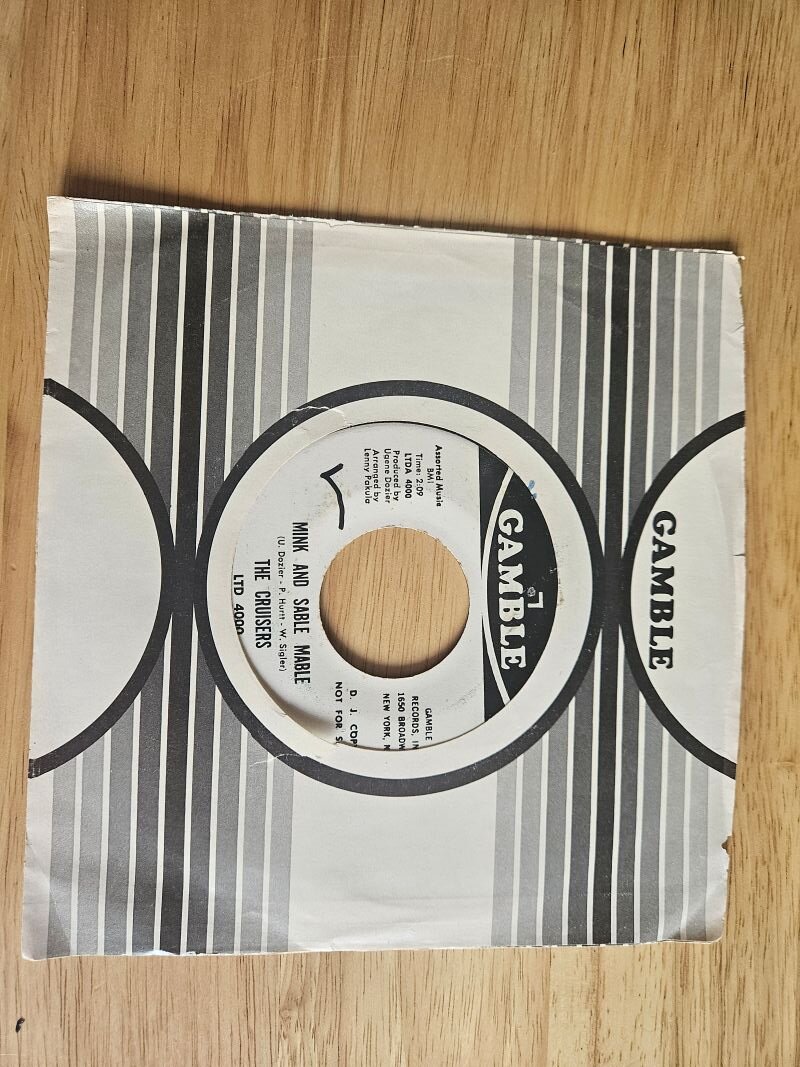

4 to Go Nice Originals.. Reasonably priced...

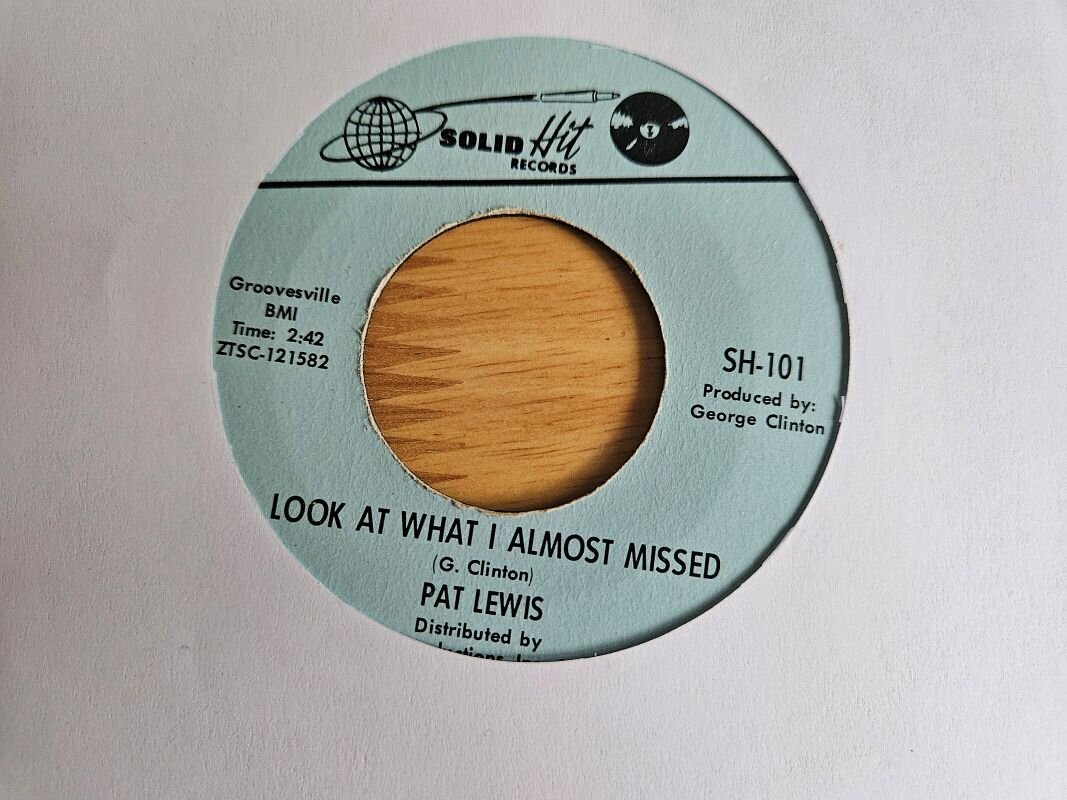

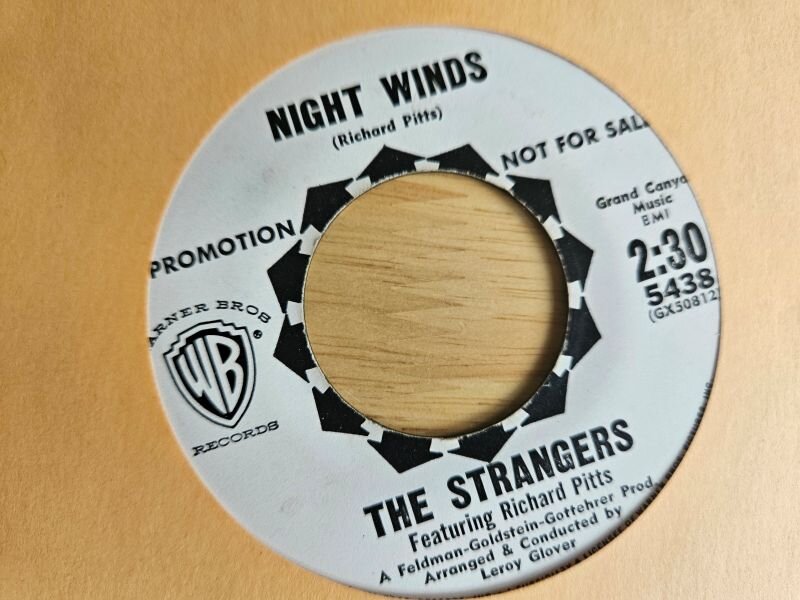

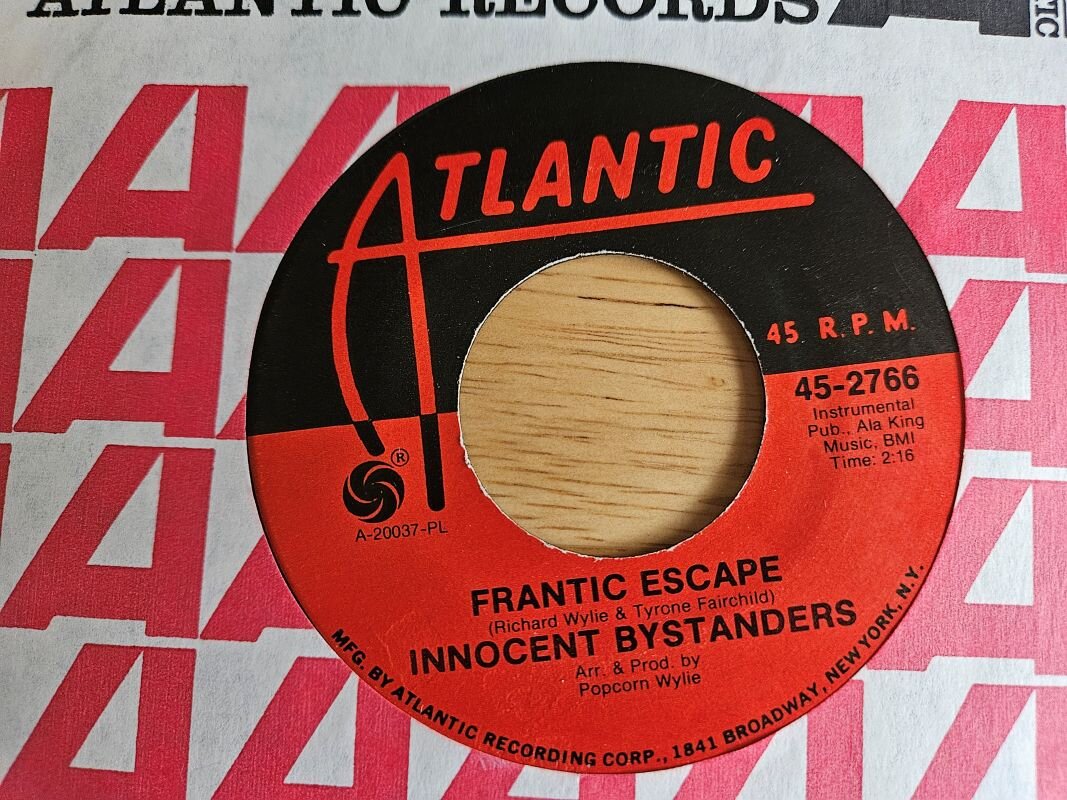

A Selection of originals for sale Post £4.95 recorded payment Pay Pal Friends and Family, Scans will be sent if interested.... 1.Innocent Bystanders – Frantic Escape / Crime Doesnt Pay - Atlantic Condition Disc retains original shine EX £ 20 2.The Cruisers -Mink And Sable Mable / Picture Us – Gamble Demo Condition Disc retains original shine EX++ PLAYED ONCE Company sleeve -£25 3.Pat Lewis -Look At What I Almost Missed / No Baby No – Solid Hit Condition Disc retains original shine odd hairline EX £15 4.The Strangers – Night Winds / These Are The Things I Love Warner Bros Demo - EX Condition Disc retains original shine odd hairline VG++ £25

-

Andrea Hendry or Janice version of I need you ?

Still retain a Janice copy,the stats on discogs says 16 Copy's of Andrea Henry Sold and only 6 Janice, I got one of the six on discogs @$80 a few years ago I like the Janice 45 myself not seen a lot for sale over the years however there is one on Discogs right now..

-

Manship half price sale

what were they? and maybe could have got them cheeper of me

-

Manship half price sale

still got his first printed catalogue back when he had the shop wasnt that great result back then did not get them all ... however had some bloody good stuff off him over the years and used the current auction all good for me...

-

Buying from USA

20% tax on puchase + postage (ebay) ,There may be a new Trump tax but it did not show up on a disc I brought a couple of weeks ago,no way round the 20% ebay takes it on payment also postage is about $22 these days so take that in account.

-

Johnnie Mae Matthews “ Cut Me Loose”/“ You’ll Be Lonely”

The one to get on Art is --- Got To Be On (The Case) TY 003 superb 45 bit of a sleeper no atco release rare...

-

Johnnie Mae Matthews “ Cut Me Loose”/“ You’ll Be Lonely”

Jam first local release then atco ,have one always play cut me loose quality 45

- Cartridge and Stylus conundrum.

-

Cartridge and Stylus conundrum.

Red ortophon is a very GOOD cartrige stylus £50 these days , You need a good deck not the crap most people have need a light arm well balanced ,recommend Linn sondeck, rega,and Logic DM 104, other wise you will ruin the records and im looking at my Bush discatron still works ..... never used these days

-

Enricoacm1899 left Positive feedback for Mithras

-

Five For Thursday All Good Prices

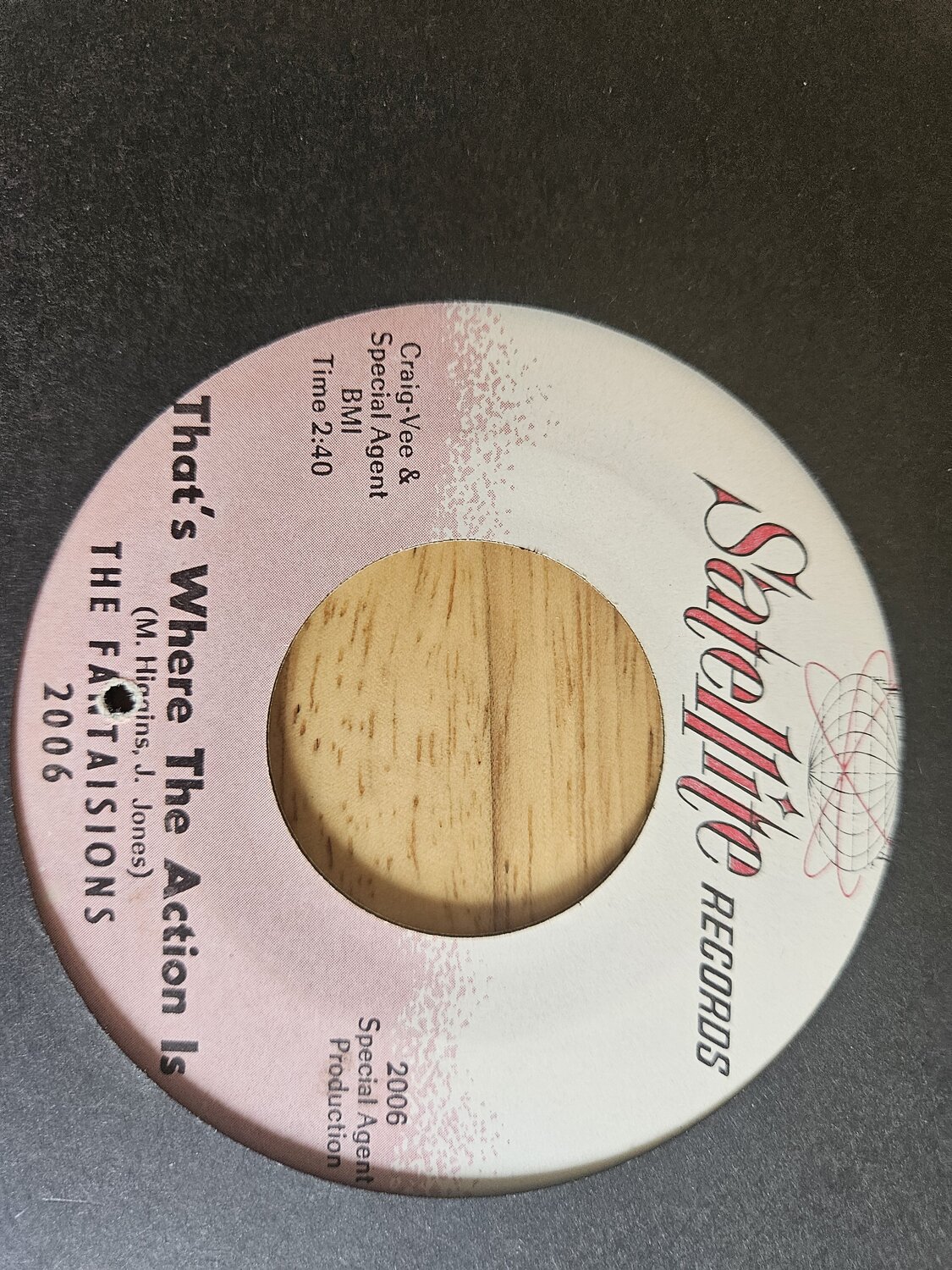

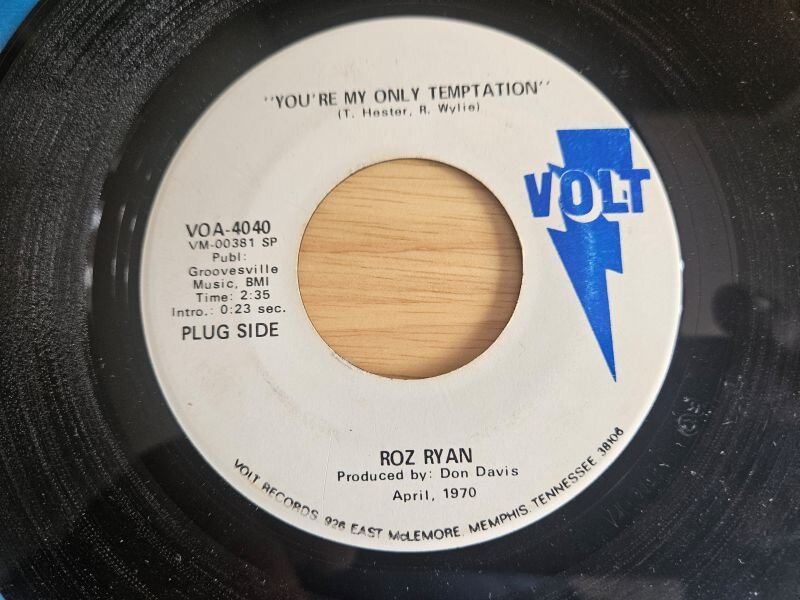

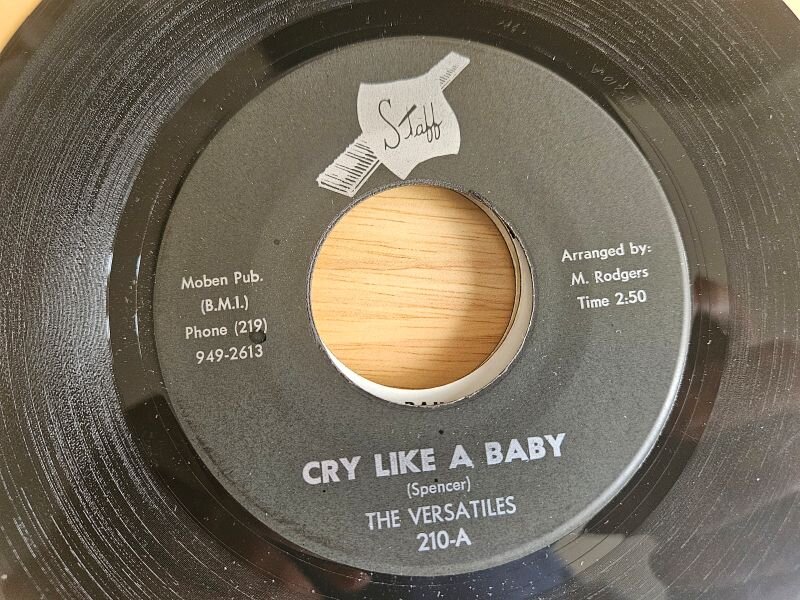

A Selection of originals for sale Post £4.95 recorded payment Pay Pal Friends and Family, Scans will be sent if interested.... 1.Freddie Scott – Girl I Love You / I Shall Be Released -Probe Demo Condition Disc retains original shine strong EX +or BETTER - £30 2.The Fantaisions – Thats Where The Action Is / Unnecessary Tears - Satellite Condition Disc retains original shine strong EX+or BETTER - £ 35 No Demo Copies Sold On Discogs Rare 3.Roz Ryan -Youre My Only Temptation / I Cant See Nothing Volt DEMO Condition Disc retains original shine light paper marks VG++ £60 4.Otis Leavill – Baby / Cant Stop Loving You – Brunswick Condition Disc retains original shine odd light mark still a nice disc EX £40 5.The Versatiles - Cry Like A Baby / Lonely Man - Staff Condition Disc retains original shine a nice disc EX £50

-

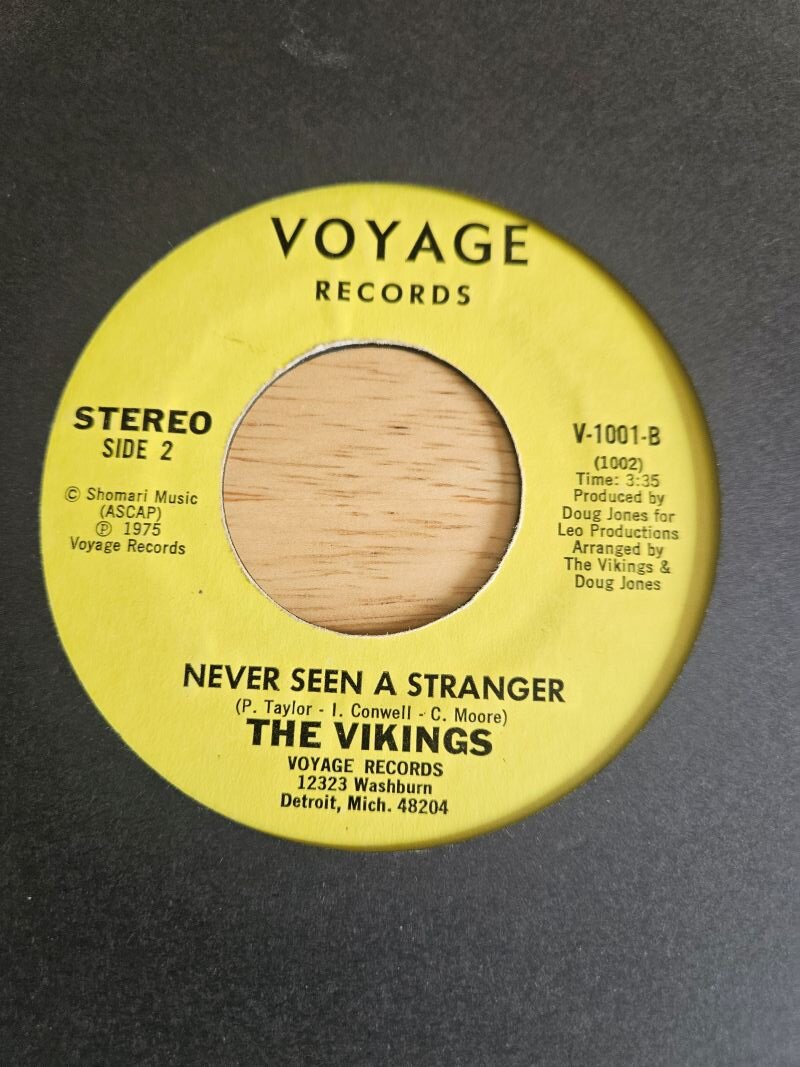

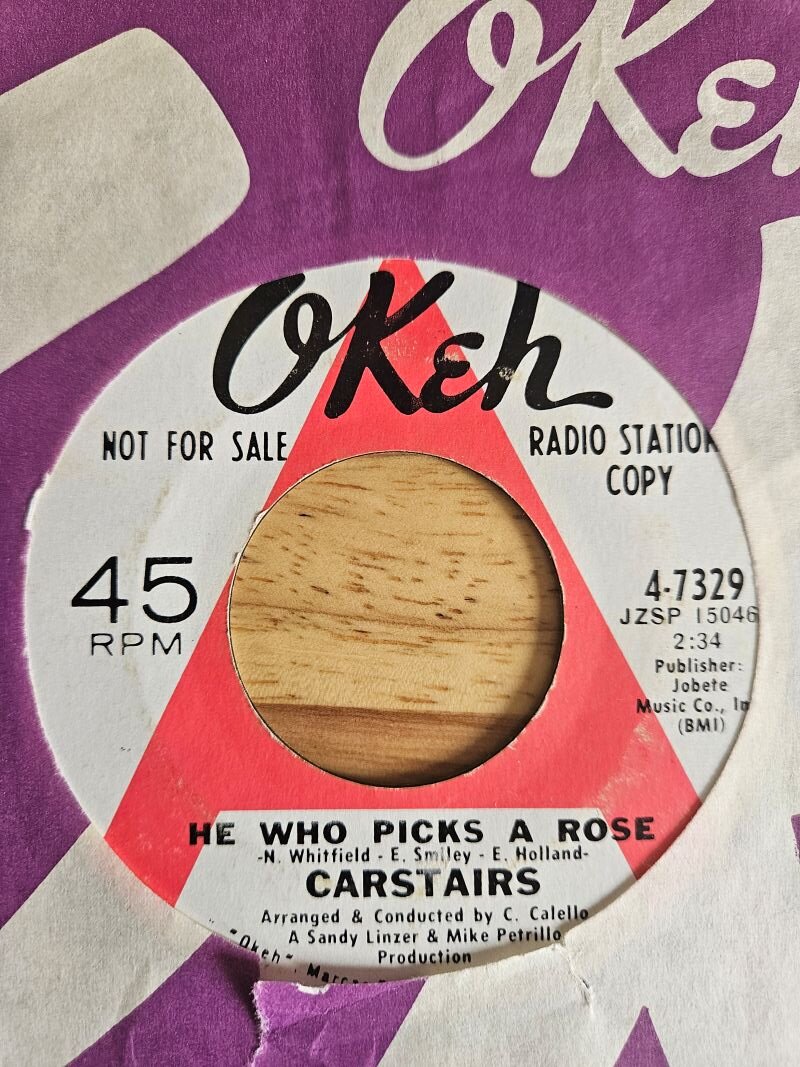

4 to Go All priced To Sell

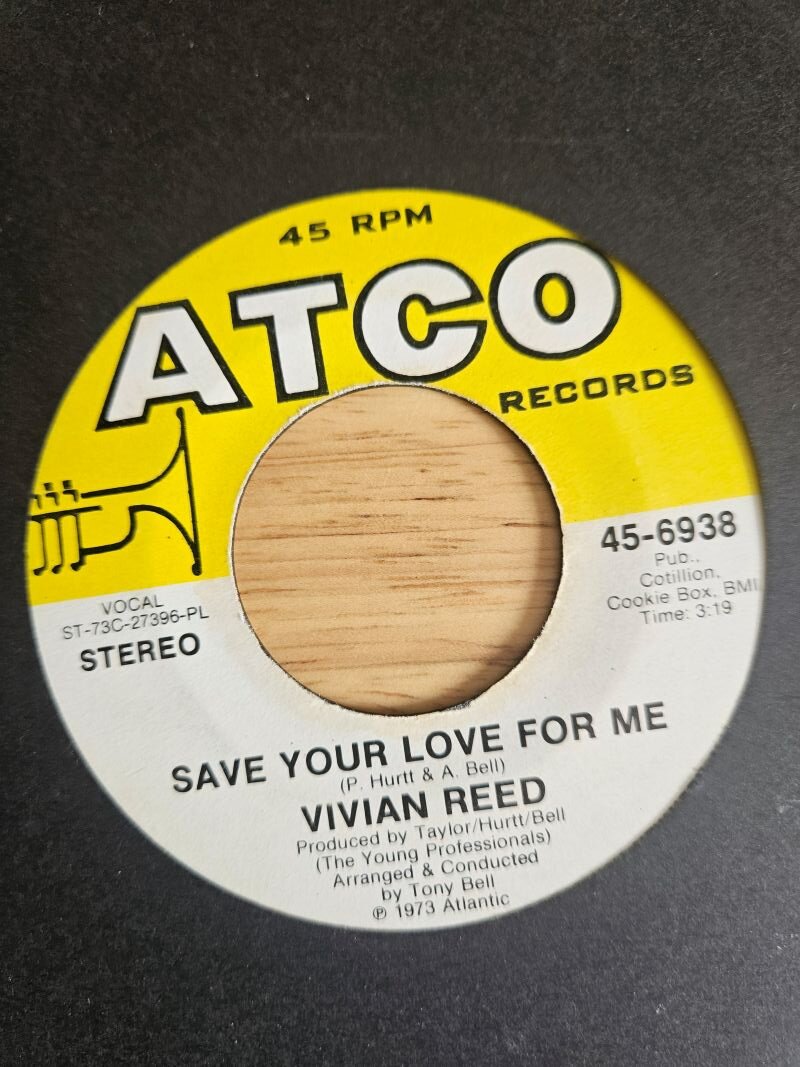

A Selection of originals for sale Post £4.95 recorded payment Pay Pal Friends and Family, Scans will be sent if interested.... 1.Carstairs – He Who Picks A Rose / Yesterday – Okeh Demo Condition Disc retains original shine slight hairlines only VG+ or BETTER - £ 65 2.The Cruisers -Mink And Sable Mable / Picture Us – Gamble Demo Condition Disc retains original shine EX++ PLAYED ONCE Company sleeve -£25 3.The Vikings – Never Seen A Stranger / Heartaches - Voyage Condition Disc retains original shine odd hairline VG++ £ 55 4.Vivian Reed – Save Your Love For Me /I Didnt Mean To Love You Atco Condition Disc retains original shine odd mark only VG+ - £ 65

-

Jayboy Records

Just got a Jay Boy press release and a mint Philip Mitcell Frre For All never played Happy Days

-

Ebay postage problem

if in the uk use the drop down menu as described earlier if in uk 3.50 can send 15 45's or 3 lp's

View in the app

A better way to browse. Learn more.