- Replies 28

- Views 5.3k

- Created

- Last Reply

Most active in this topic

-

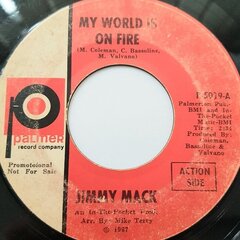

Jimmy Mack 5 posts

Jimmy Mack 5 posts -

Mike Lofthouse 2 posts

Mike Lofthouse 2 posts -

Johnty 2 posts

-

Tlscapital 2 posts

Tlscapital 2 posts

Most Popular Posts

-

i phoned hmrc about being charged VAT on a 7" that was 50years old ,VAT wasn't invented when this was out and it was second hand ,not having it anything that comes into the country is rated for VAT i

-

A lot have been said already. Taxes is a very old practice. Existing since the days of old (Kings and Queens, Elfs and Hobits...) called differently according the morality of the day with sometimes sl

-

a bunch of Cee U Next Tuesday's

Just wondering is anyone else getting hit with custom charges more regularly? My last 3 buys from US have been and wondered if it was a new crackdown