- Replies 45

- Views 4.1k

- Created

- Last Reply

Most active in this topic

-

Denbo 8 posts

-

John Reed 6 posts

-

Soul-slider 3 posts

-

Gogger 3 posts

Most Popular Posts

-

I had a record from the us last week value on packet of $87 did'nt pay anything extra but the writing was very small and faint so my postie must need glasses thank god.

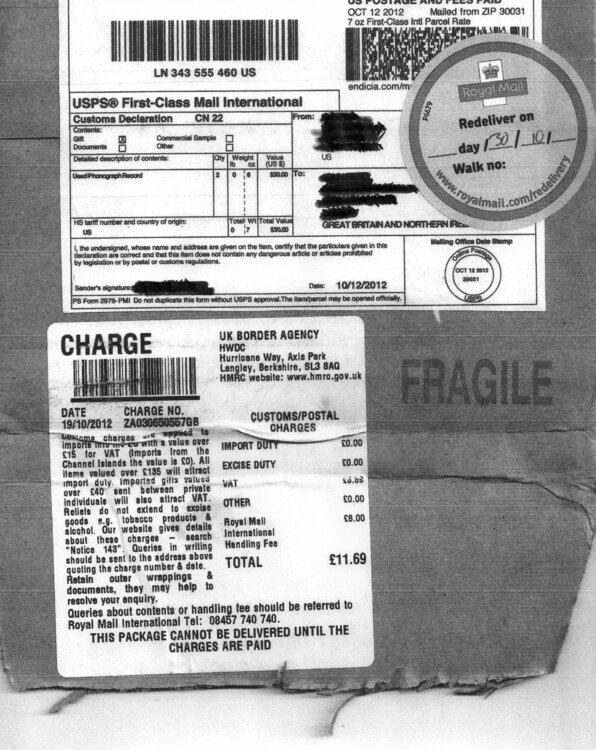

On top of the administration fee charged by Royal Mail, is there any way of calculating what the import duty will be against a rising scale of US Dollar value?